Register for the TransAction Portal (TAP)

Use these steps to create your TransAction Portal (TAP) account. The process includes setting up your login, verifying your email, adding security features, and confirming your identity.

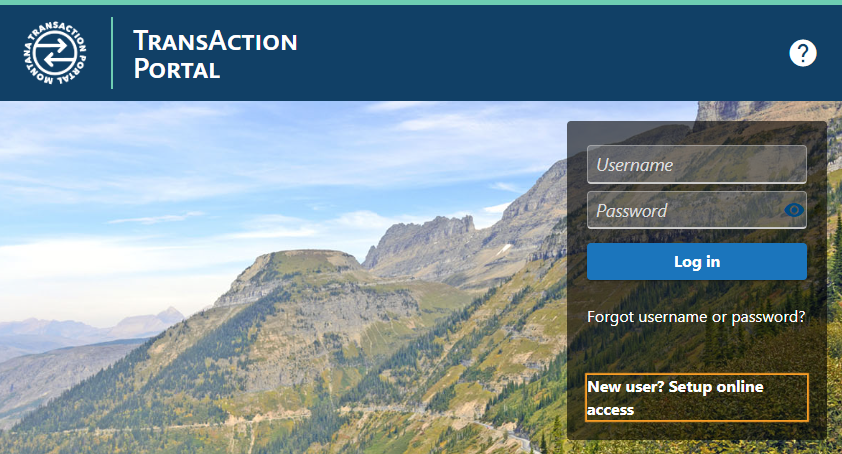

- Go to the TransAction Portal (TAP).

- Select New user? Set up online access.

- Fill out the required fields: name, username, password and email address.

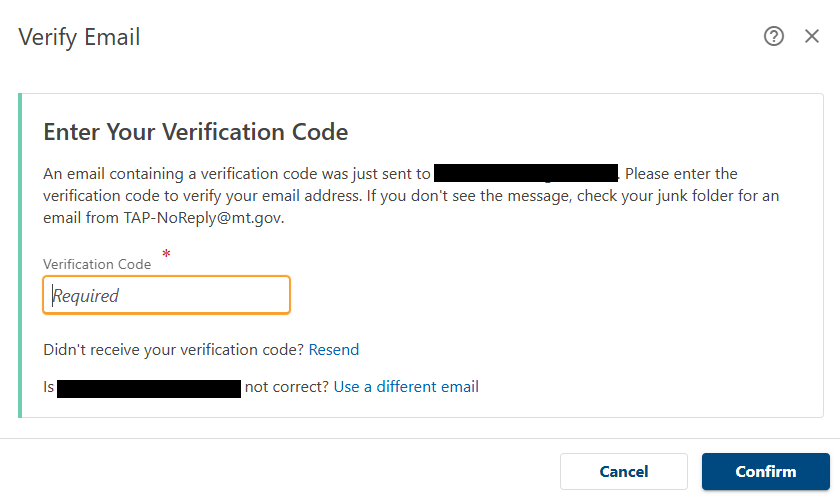

- Check your email for a message from TAP-NoReply@mt.gov and enter the verification code.

- If you don’t receive the code, select Resend or choose Use a different email if needed.

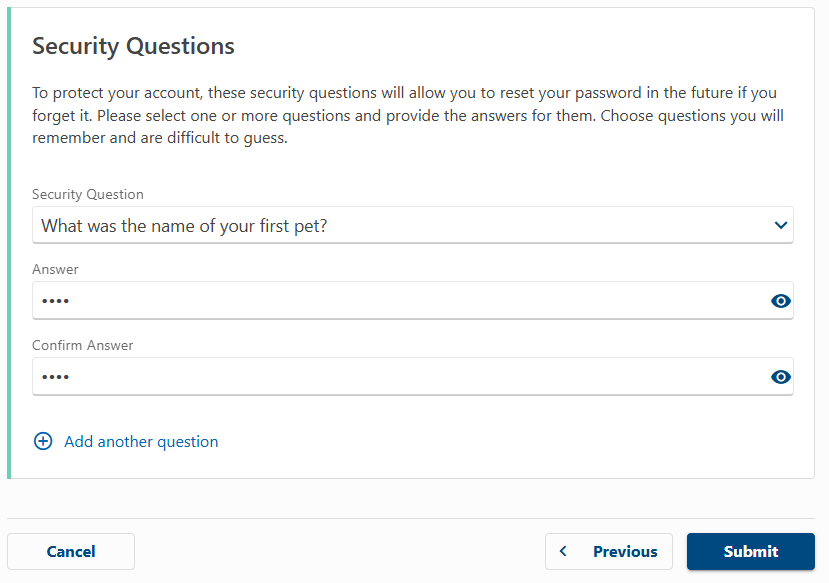

- Choose one or more security questions from the dropdown menu.

- Enter your answer and confirm it.

- Select Submit to continue.

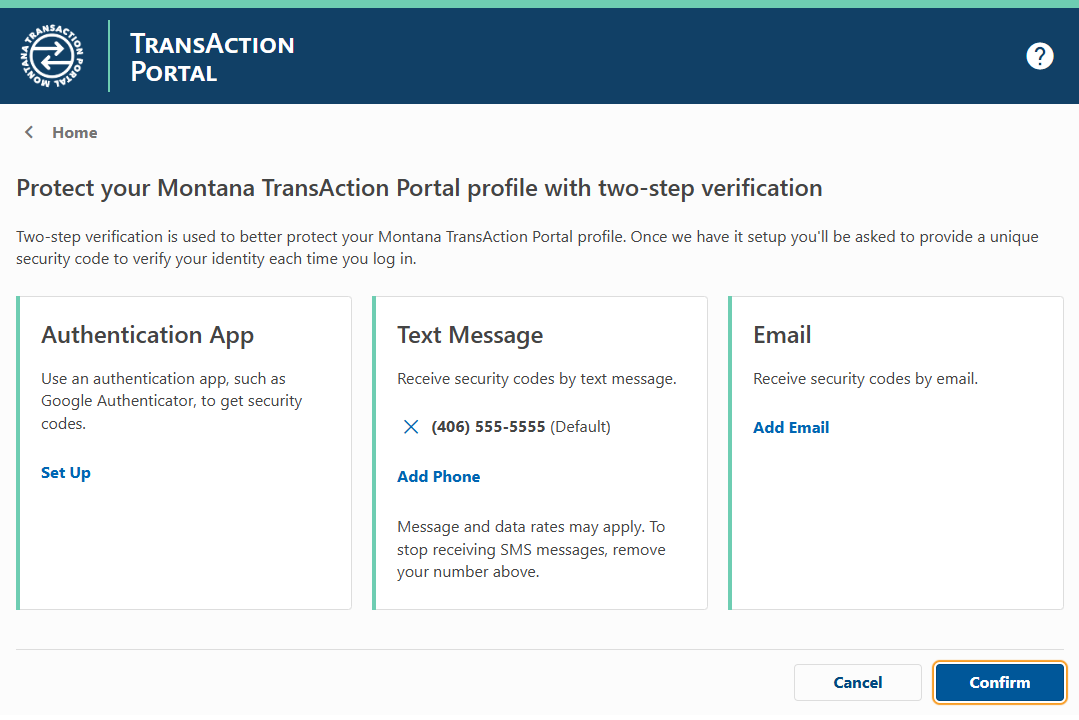

- Choose how you want to receive your security codes:

- Authentication App (like Google Authenticator)

- Text Message

- Follow the instructions for your selected method and select Confirm.

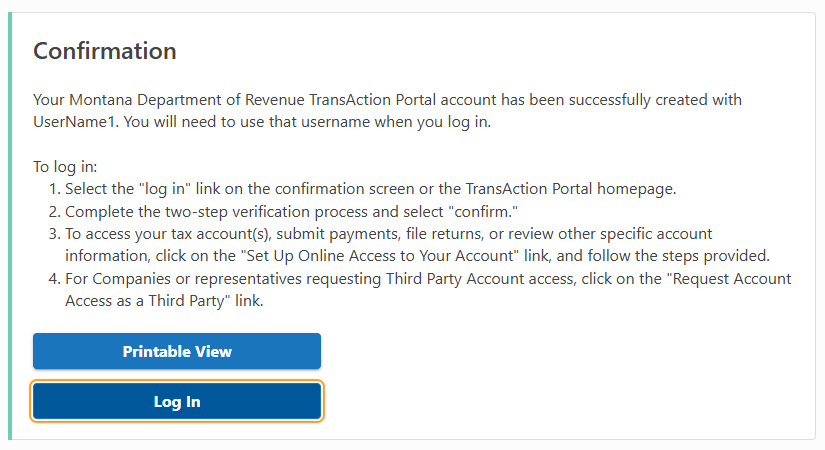

- On the confirmation page, select the Log In option.

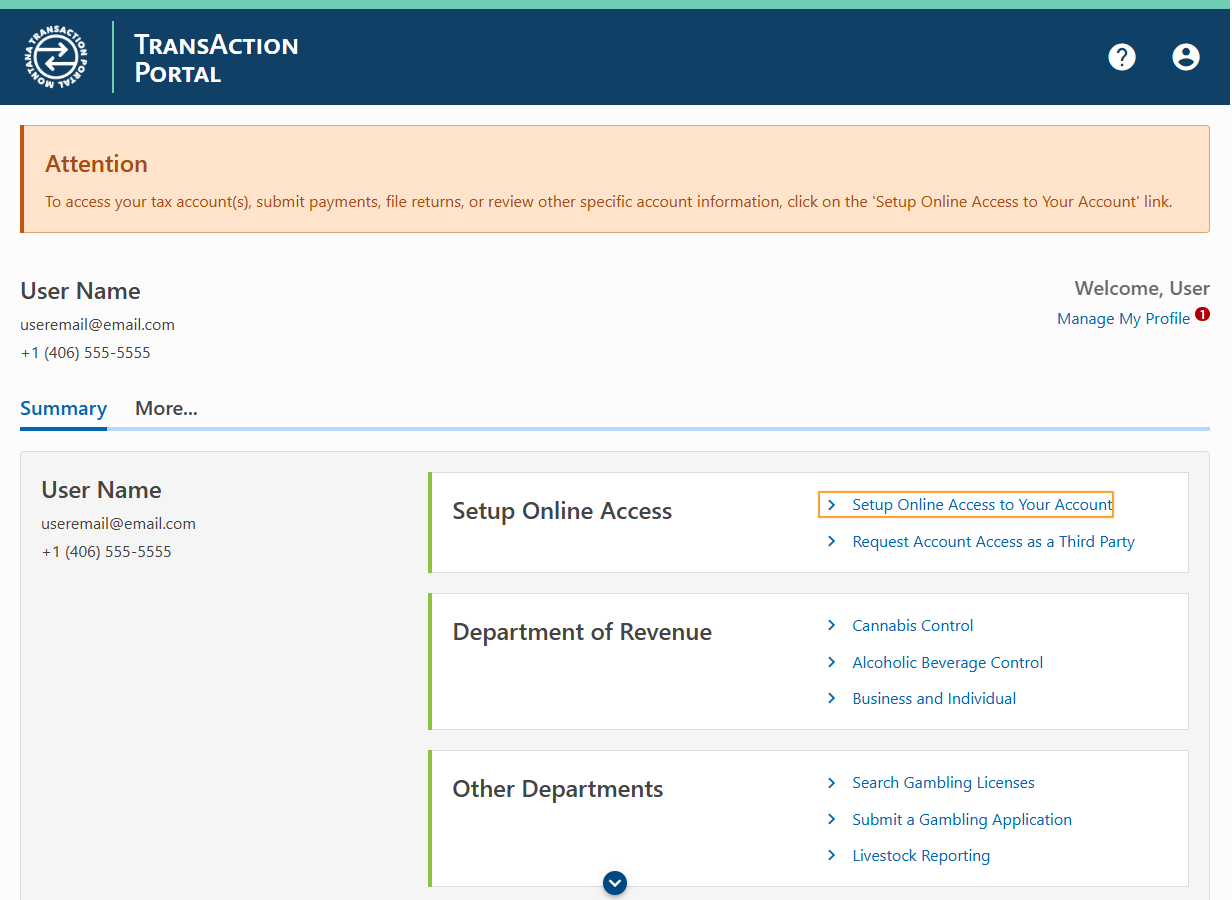

- Once your login is created, select one of the following:

- Setup Online Access to Your Account, or

- Request Account Access as a Third Party

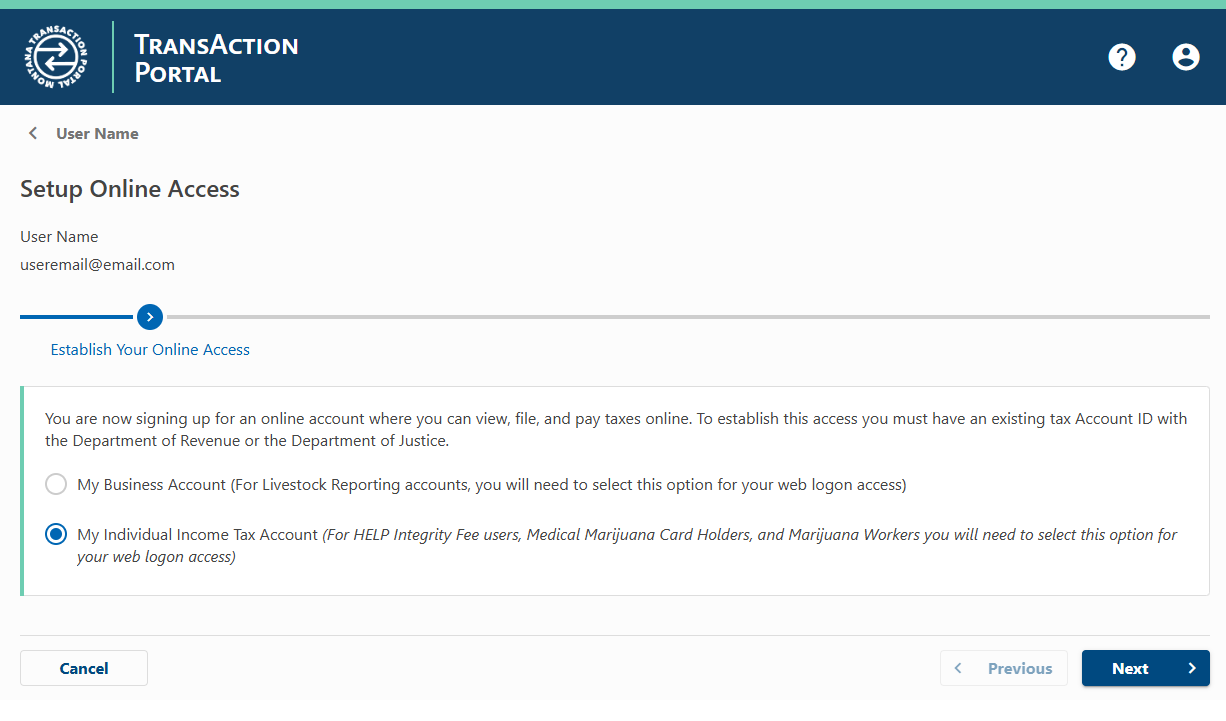

- Select My Business Account if you are registering for a business (such as Livestock Reporting).

- Select My Individual Income Tax Account if you are registering for personal taxes, HELP Integrity Fee, Medical Marijuana, or Marijuana Worker accounts.

- Click Next to continue.

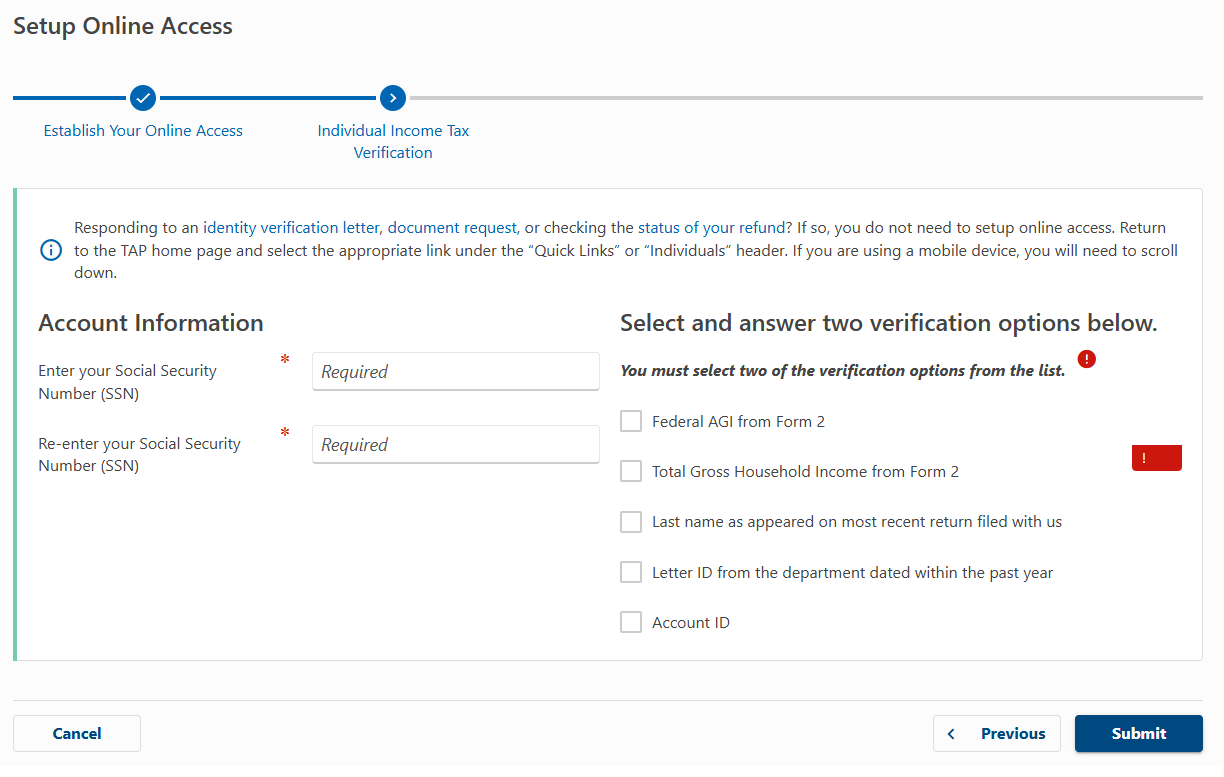

During this step, you will need to verify your Department of Revenue account information.

- Enter and re-enter your Social Security Number (SSN).

- Select and answer two verification options from the list:

- Federal AGI from Form 2

- Total Gross Household Income from Form 2

- Last name from your most recent return

- Letter ID from the department dated within the past year

- Account ID

- If you do not have a recent letter, you can request one from the Department of Revenue to complete verification.

- Click Submit to continue.